In less than a decade, Chinese e-commerce sites have remade American shopping. A recent analysis by Salesforce found that apps such as Temu, Shein, AliExpress, and TikTok “will account for one in five purchases over the holiday season.” For Amazon, the largest American online retailer, these competitors have gone from a marginal trend to a real threat.

And so this week, Amazon is rolling out Haul, a new section — a storefront, really — to its hundreds of millions of users. Haul is “a place to discover even more affordable fashion, home, lifestyle, electronics, and other products with ultralow prices and typical delivery times of one to two weeks,” the company says. Everything is under $20, and it’s only available on mobile. The moment you open it, the inspiration and intentions are clear: Amazon built itself a Temu.

If you’ve tried Temu, Shein, TikTok Shop, or even AliExpress, you’ll notice a few familiar things right away. There’s the busy, animated interface jammed with hawking enticements: Save 10% on 75! Pssst. Add $18.01 for free shipping! Banners and tickers and buttons eventually give way to a wide, staggered grid — the default discount shopping-app interface — full of algorithmically chosen products with, indeed, “ultralow” prices. One of the strange but effective things about these apps is that prices often precede products: The numbers draw your attention, suggesting pocket change and priming the shopper for an impulse buy. Only then is your eye drawn up to the image and caption, and even then it’s not always clear what, exactly, is for sale. This might sound like a strange way to find what you’re looking for, and it is, but that’s not the point. The companies Haul is imitating are masters at getting people to keep scrolling, tapping, and engaged until they finally relent and buy something.

Haul, which is still in beta, isn’t deploying every discount shopping-app trick — no pop-up games and spinning wheels yet. But it’s still fascinating to see Amazon, which almost unilaterally set American norms and expectations around online shopping more than two decades ago, so fully go into chase mode. For now, though, the package feels incomplete. I’m not really in the target demo for a lot of the most popular products here, but in the course of years of reporting — and some shopping — I’ve spent a lot of time with them. Haul’s first issue is its presentation. All the promotional copy is about “crazy low prices” and “unbelievable finds.” Everything is “selling fast” and there are emojis everywhere: rockets, flames, and a variety of shocked and smitten faces. But there’s nothing “unbelievable” or “crazy” here in 2024, unless you’ve never shopped anywhere except Amazon. A half-dozen wildly popular apps have been selling people stuff in this exact style and at similarly low prices for years. Haul is one more way to shop an increasingly globalized inventory of brandless, slow-shipping treats and/or junk, which, in its alternately depressing and seductive comprehensive cheapness, speaks for itself.

Haul’s bigger problem is that, while it stocks a lot of the same anonymous stuff — the exact same products, in fact, with the same promo images — as Temu or TikTok Shop, it currently seems to have less of them. Budget shopping apps work not just because they feel like feeds but because those feeds are chaotic and unpredictable: You come across lots of weird items, products that don’t make a ton of sense at first glance, and products, or copies of products, that might feel slightly familiar from social media or the broader world of retail. Lately, that has included more expensive and branded items; both Temu and TikTop Shop have been moving upmarket to compete more directly with Amazon. Haul, at launch, feels a lot like its competitors, except with the most enticing — or, at minimum, stimulating — listings left out.

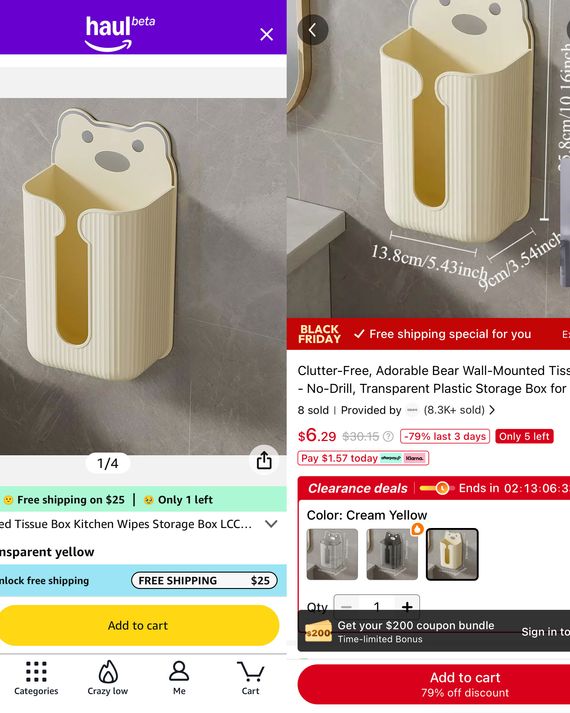

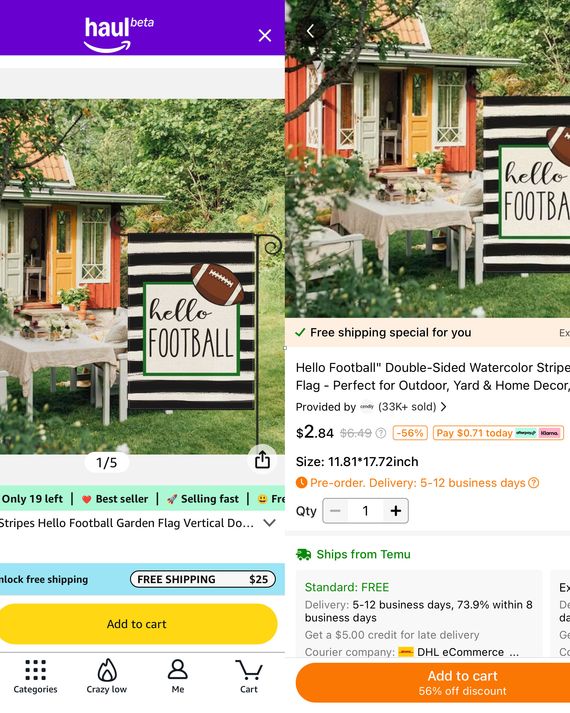

It was easy, for example, to track down promoted and (allegedly) popular Haul products on Temu. A wall-mounted tissue box that looks like a bear is listed for $6.99; on Temu, it’s $6.29 and comes with a free shipping promotion (Haul purchases include Amazon’s money-back guarantees but no Prime shipping — as on similar apps, shipping takes anywhere from a few days to a couple weeks). The product is the same. The product images are the same. You can repeat this process with almost anything: the same anonymous phone case on Haul for $3 and Temu for $3.60; a yard sign that says “Hello Football” with the same fake and misleadingly proportioned product image for $2.99 on Haul and $2.84 on Temu.

It was more illuminating to try this experiment the other way around. Earbuds are always a useful benchmark for discount apps: There are a ton of branded and unbranded options; they’re desirable, sell a lot, and get prime placement and discount treatment. Haul simply doesn’t have any at the moment — just a bunch of rubber cases, tips, and other accessories. After a while, you start to realize why Haul feels more like an algorithmically disorganized wholesale catalogue than the hyperpromotional “shop like a billionaire!” manipulation machines on which it’s based: Where are the dubious face-sculpting tools? The TikTok-famous alarm clocks? Where are all the Stanley tumbler dupes??? There are plenty of examples like this, which seem like a major oversight but also maybe the sort of thing that Amazon can fix — if it wants to. In the meantime, to borrow a joke, Haul feels like a Temu… Temu.

It’s possible, though, that these gaps hint at a more fundamental challenge for the whole enterprise. Haul is a response to companies that are undercutting Amazon by shipping products directly from sellers in China. If these competitors were selling an entirely different set of products, Haul’s existence would make a lot more sense. Increasingly, though, the likes of Temu are selling a lot of the same stuff you can find in Amazon’s main store.

For years, Amazon’s sales have been dominated not just by third-party sellers but by foreign third-party sellers, mostly based in China and with access to considerable manufacturing capabilities and cheap labor. This shift began well before the rise of apps like Temu and was a pretty good deal for the cross-border sellers and Amazon alike. Chinese merchants got access to American customers and Amazon’s logistics and delivery infrastructure; Amazon took substantial fees from sellers to warehouse and distribute goods, and for access to Amazon Prime. In prioritizing direct-from-China Amazon sellers over domestic sellers who were often sourcing their products from China anyway, Amazon was, in its view, cutting out middlemen. Now Amazon is the obvious remaining middleman, and its competitors — thanks to a favorable (and recently threatened) collection of shipping and tax policies — are ruthlessly trying to cut it out, too. The least flattering comparison for Amazon isn’t Haul versus Temu or TikTok, but rather Temu versus Amazon, where you could already find a lot of Temu-type products sold at much higher prices (but with faster shipping), and where you can buy earbuds, but they cost twice as much as the ones that ship straight from Guangdong Province.

You can follow the logic of Amazon’s internal division here — cut-rate imports go there, while high-margin logistics customers sell here — but its competitors don’t have to operate that way, and it makes each business less competitive. Amazon has to protect its much more profitable main brand and maybe hold back some of its more lucrative categories entirely. Temu can sell whatever it wants, at least for as long as its parent company is willing to subsidize its attack on Amazon. A reasonable case for Amazon Haul is that maybe Amazon can convert some new budget shoppers into lifelong Prime customers. The strongest argument, though, is that it probably didn’t have a choice.

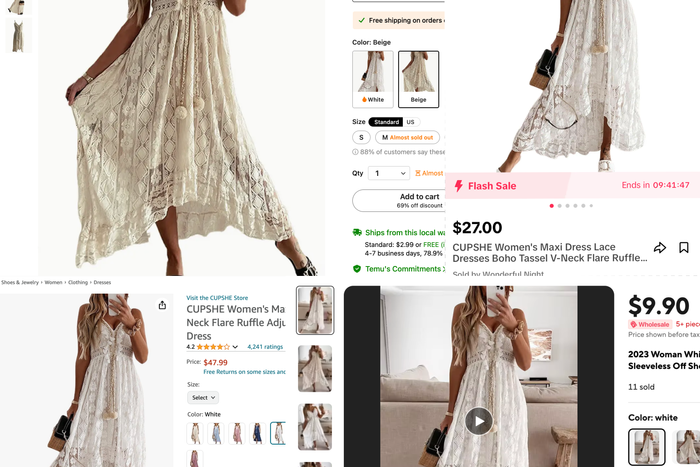

Haul also arrives at a strange political moment. Amazon, with its own deep economic ties to and dependencies on China, has been trying to figure out how to respond to foreign e-commerce platforms for years, and its response landed just in time for two major complications. One comes from the Biden administration, in the specific and targeted form of proposals limiting so-called de minimis shipments. These exempt low-value items from import duties and taxes, working in favor of platforms like Temu and Shein (among the main categories addressed here would be clothing). Material changes could take effect as soon as December — though the proposals may still fall apart.

The other complication comes from the incoming Trump administration, which has promised broad and severe tariffs on imports from many countries, with especially high rates proposed for products coming from China. The potential outcomes here range from awkward but ultimately beneficial to Amazon (these policies might undermine Haul but would more importantly neutralize Temu and TikTok) to fully disastrous for the company (massive price increases for most of what Amazon sells). The next few months will be crucial for Haul, and for the Everything Store itself. In the meantime, well, enjoy Black Friday.

More From This Series

- How Podcasting Became the New TV

- Why the Government’s Google Breakup Plan Is Such a Big Deal

- Will Donald Trump Save TikTok?