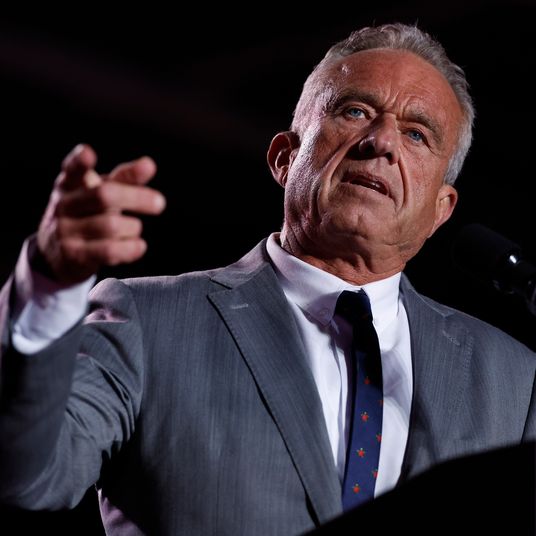

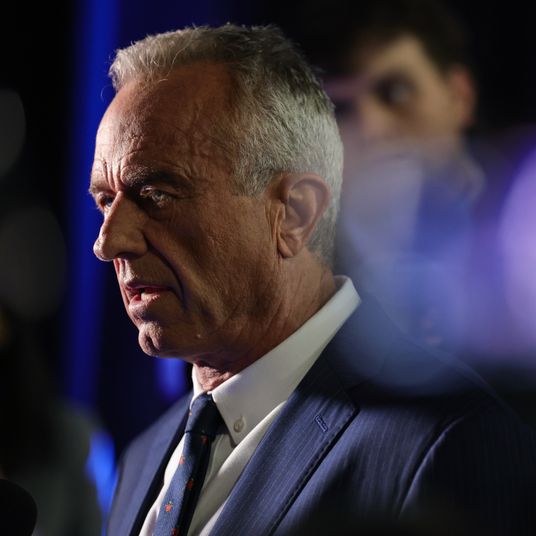

Donald Trump has until Monday afternoon to come up with a half-billion dollars, or New York attorney general Letitia James could seize his assets, including properties. Last week, he revealed that he doesn’t have the cash to pay the $454 million fraud penalty leveled against him in February — and that he can’t find anybody to post a bond for him, either. “If he does not have funds to pay off the judgment, then we will seek judgment enforcement mechanisms in court, and we will ask the judge to seize his assets,” James said last month following her court victory. “We are prepared to make sure that the judgment is paid to New Yorkers, and yes, I look at 40 Wall Street each and every day.”

After Justice Arthur F. Engoron found Trump, his company, and officers including his two eldest sons civilly liable for a decades-long scheme to commit financial fraud last month, the biggest question was: How the hell is he going to pay? Trump is a billionaire, but he doesn’t have hundreds of millions in cash stowed away in a safe. Most of his fortune is tied up in property and contracts — assets that are owned by a Matryoshka doll of corporations that collectively form the Trump Organization. Some of that cash may have to be reserved for paying nearly $92 million for defaming E. Jean Carroll twice. (He secured a bond in that case last week.) For all that the public knows about Trump, his true financial position is a mystery.

Trump is appealing Judge Engoron’s decision, but challenging a ruling doesn’t mean he is off the hook for the funds. So will we see the state put Trump Tower up for auction? “What’s going on now, as with all things involving the Trumpaverse, there’s no precedent or analog for it,” said one retired New York judge who’s been closely following the case. It turns out that actually collecting the money is the most complicated part of the civil case against Trump.

The judgment is one of the largest ever in New York, and the sheer size of it — as well as the political implications of the defendant — make this case impossible to predict, according to experts who have followed the case. “What’s extraordinarily unusual about this case is there’s nobody in the history of the State of New York who’s had to put up a bond of half a billion dollars,” the former judge said. “There’s no danger that she won’t be able to collect on this judgment. He has enormous assets in New York, and elsewhere … If his name wasn’t Trump, this wouldn’t be a discussion.” Trump has multiple avenues through the appeals and bankruptcy courts to tie up the effort to collect the judgment, and the extremely complicated nature of his assets would make asset forfeiture a difficult endeavor. It could be years before he has to actually pay any penalties for the civil fraud case — if ever.

Trump’s first maneuver is at the appeals court, where he has already won some concessions. In his appeal, he called the fines and the restrictions on him and the Trump Organization “far-reaching punitive injunctive relief” and asked the court to consider whether Engoron had made any errors in his ruling. In late February, Judge Anil Singh stayed two of Engoron’s judgments: Gone are restrictions on Trump being an officer of a company in the state and from getting a loan from a financial institution overseen by New York regulators. Singh left the financial penalties intact, though, and refused to lower the amount he could post for a bond to $100 million. After that ruling, Trump took his appeal over the bond to a panel of five judges who have the power to lower his bond payment or stay the Monday deadline altogether.

Trump has filed notices that he plans to appeal Engoron’s ruling, including the judgment, which will be considered by separate panels and will take months to wind through the court system. Once the court takes up that appeal, Trump will have another chance to knock down the $454 million penalty by going after how Engoron came to that figure. The attorney general argued that the reason Trump got favorable terms for lenders is because he presented them fraudulent financial statements. The problem with that reasoning, as my colleague Andrew Rice put it after hearing Trump attorney Christopher Kise’s court statements, is this:

Donald Trump allegedly lied to lenders about how rich he was in the 2010s, and that allowed him to borrow money that he wouldn’t have otherwise had to spend, which resulted in dishonest profits. Trump’s legal team countered that real-estate valuation was inherently subjective and that even if some of the numbers were off, none of the lenders involved complained about it. In fact, some of the bankers had testified that they had been more than happy with Trump as a client. “They rolled out the red carpet,” Kise said, “and they’re dragging President Trump through the door.”

Of the $454 million Trump owes now in penalties, more than $169 million was for defrauding Deutsche Bank. The AG’s office argued that if Trump had revealed his true financial position, he would have had to pay that much more in interest on loans. However, Deutsche Bank’s own employees testified to the contrary. “Through our due diligence we have concluded that DJT has an exceptionally strong financial profile,” the bank had written in internal communications as part of the justification for giving Trump the loans. The case was largely built around an expert witness, whose conclusions Engoron largely adopted in his judgment. Trump’s side, however, has argued that since Deutsche Bank didn’t rely on his financial statements and did its own due diligence, it was never misled or victimized in the first place.

Should Trump lose his appeals, he has other options. For one, he, or any one of his companies, could file for bankruptcy. That would immediately stay any state-court judgment while matters move through a parallel bankruptcy-court proceeding, according to two attorneys who’ve closely observed the case. In that case, a bankruptcy judge may appoint a trustee who would oversee the estate, effectively ceding control of the Trump Organization to the court, which will decide what assets to sell and for how much. There is no guarantee that filing for bankruptcy will actually protect Trump or his companies from Engoron’s judgment, though. “I wouldn’t be surprised if the state tries to dismiss the bankruptcy case, because Trump arguably isn’t in financial distress. It’s a two-party dispute between him and the state,” said another former New York judge.

Trump’s fortunes did improve somewhat late last week. On Friday, shareholders in his social-media company, Truth Social, voted to merge with a SPAC — a deal that could net Trump about $3 billion worth of shares. But there are strings that come with the deal, which stop him from immediately selling or pledging the shares, such as using them as collateral to secure a bond. Even if he can’t part with the shares, though, they would be eligible for seizure by James and, in theory, satisfy the penalty he owes.

But taking anything else from Trump would be more complicated. In order to physically seize property, James’s office needs to go to court. (Her office made a legal filing in Westchester County where two of Trump’s most valuable properties, a golf club and estate, are located.) If a judge approves, the county sheriff would put liens on the properties. At some point — probably after the appeals are over — the office would make a motion to sell the properties, then put them up at auction. Even then, it would not be over, because it’s not clear who else would have claims on assets given the Trump Organization’s complicated corporate structure, as well as his many partnerships with other lenders and real-estate developers. If a bank, or another investor, has a claim on a property, they would likely get paid ahead of the state following a sale. “What you don’t know with someone like Trump is that, whatever assets he has, it’s hard to figure out what other claims may be ahead of the claims,” the second judge said of the courts. “My personal opinion on why these institutions don’t want to deal with him is because they don’t want to spend the rest of their lives litigating these things.”